Family Office Intelligence

Ask like a Principal.

Decide with confidence.

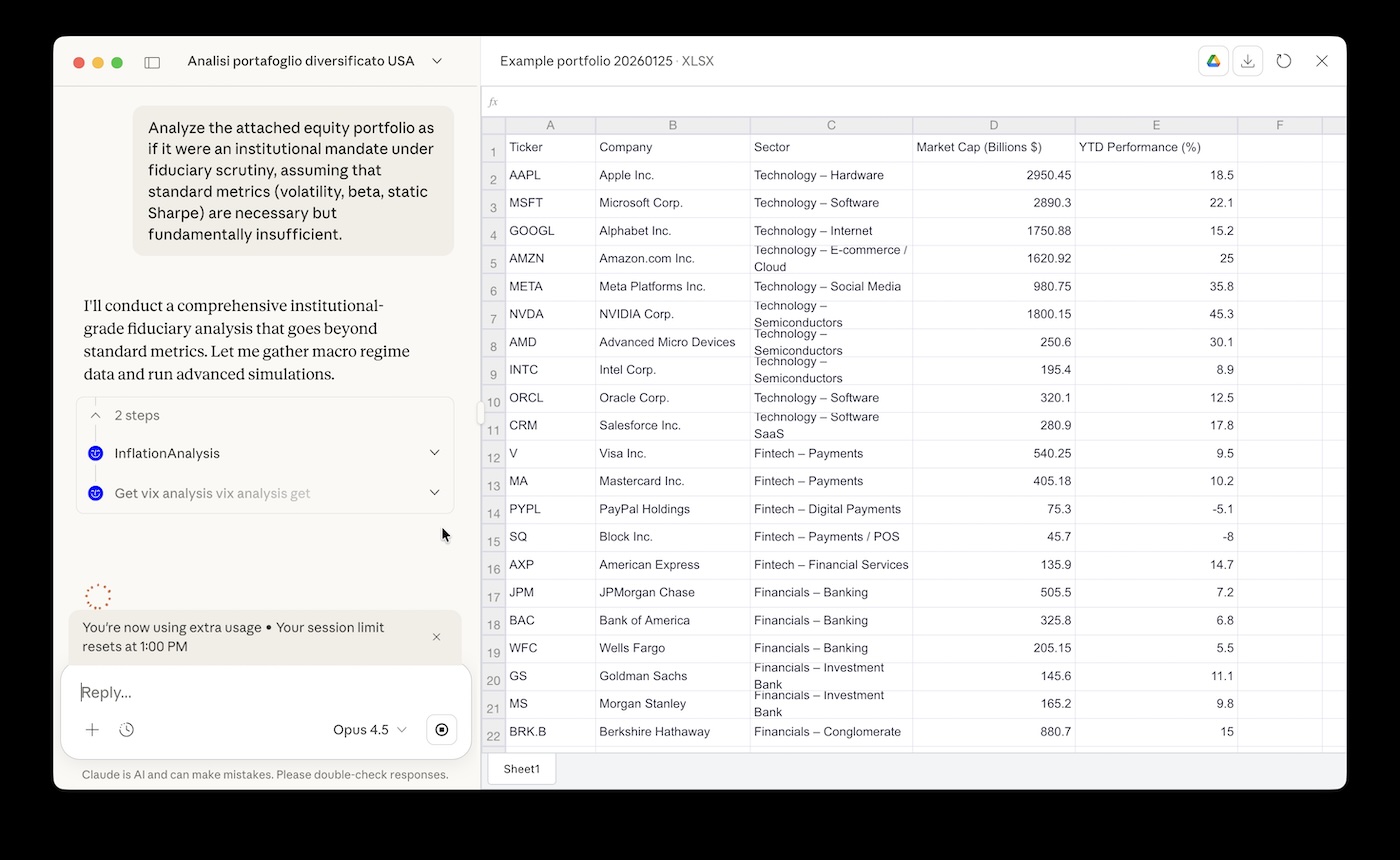

Institutional-grade financial intelligence built for Family Office asset managers. Advanced analytics, AI-powered insights, and comprehensive risk management—unified in a conversational interface.